About Us

As tax and wealth strategists, we help high-net-worth and high-income earners navigate the complex landscape of taxation law and regulations. Our 15-Minute assessments will give you insight into principals-based tax strategies that will transform your tax and mitigation experience!

Who We Are

At our core, we are a family and team of tax professionals who believe that helping our clients create a legacy is our mission and an essential part of our values-based approach to tax strategies and planning. We help families strategically grow their assets and wealth by limiting or mitigating their tax burden thru comprehensive and proven tax strategies commonly used by other affluent families.

20+

Year of industry exprience

OUR CORE TAX STRATEGIES

We Work With a Team of Tax Professionals to Help You Organize, Setup and Execute The Below Listed Strategies.

Schedule a Meeting With One of Our Tax Professionals to Help You Start Your Tax Savings Journey.

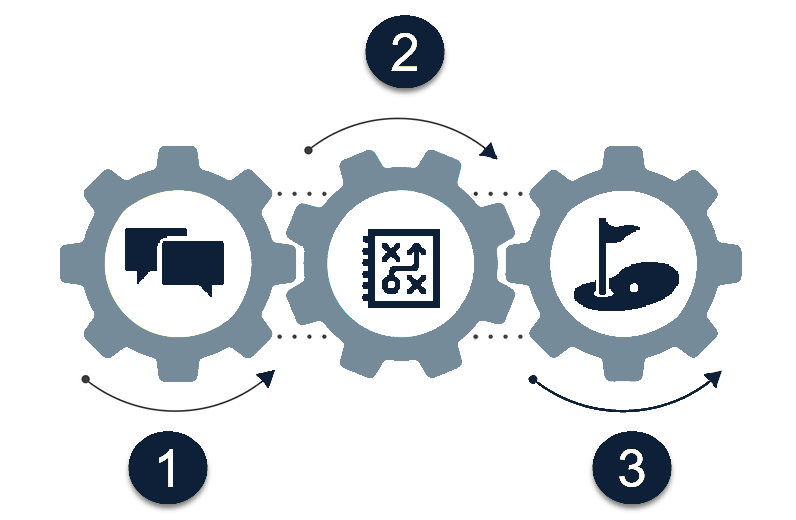

Our 3 Step Engagement Process

At our core, we are a family and team of tax professionals who believe that helping our clients create a legacy is our mission and an essential part of our values-based approach to tax strategies and planning. We help families strategically grow their assets and wealth by limiting or mitigating their tax burden thru comprehensive and proven tax strategies commonly used by other affluent families.

Step 1 - Schedule a Discovery Session

We start engagements learning about you and any business you own. It’s crucial to understand your current financial and tax situation. This includes reviewing your income sources, investments, deductions, previous tax returns, and any current strategies you’ve implemented. It sets the groundwork for developing a personalized tax mitigation plan.

Step 2 - Evaluate Your Current Plan

The next step involves evaluating the effectiveness of your existing tax strategies and identifying opportunities for improvement. This includes comparing your current strategies with those used by the affluent and super-wealthy, looking for gaps, potential risks, and areas where you might not be fully utilizing available tax advantages.

Step 3 - Get Your Customized Plan

This final step is to develop and implement a tailored tax mitigation plan. This involves choosing the best strategies from those used by the affluent and super-wealthy, aligning them with your personal and financial goals, and setting up a schedule for regular review and adjustment based on changes in tax laws and your personal circumstances.

MEET OUR TEAM

The team behind One Atlanta Tax Solutions is made up of qualified professionals passionate about helping individuals, families, and business owners protect their wealth by leveraging tested legal strategies.

OUR CORE TAX STRATEGIES

The Following Strategies Should be Administered by Qualified Professionals.

We Work With a Team of Tax Professionals to Help You Organize, Setup and Execute The Below Listed Strategies.

Set Up a Meeting With One of Our Tax Professionals to Help You Start Your Tax Savings Journey.

Navigating the Complexities of 831(b) Risk & Tax Mitigation Strategies

Get a Step-by-Step Guide for High Net-Worth Individuals & High Income Earners. Everything You MUST Know About Using 831(b) To Save On Taxes

Charitable

A Charitable Limited Liability Company (LLC) is a specific type of business entity that combines elements of a traditional LLC with a nonprofit organization’s charitable purposes and activities. It is designed for individuals or groups wishing to pursue social or charitable goals and profit-making activities within a single legal structure.

Qualified Plan Exit

A Qualified Plan Exit Strategy is a method for handling one’s retirement savings upon leaving a company or retiring, particularly regarding a qualified retirement plan such as a 401(k), 403(b), or traditional IRA. Qualified plans are employer-established retirement plans that meet specific IRS criteria for tax advantages.

Mezzanine Offers

In the context of tax planning, a mezzanine offer typically refers to a financial strategy that combines debt and equity instruments to optimize tax benefits. The term “mezzanine” generally refers to a middle layer or intermediate stage, and in tax planning, it represents a hybrid financing structure.

Bonus Depreciation

Deduct a Large of the Purchase Price of Eligible Business Assets…stimulus to encourage businesses to buy equipment and invest in themselves, which in turn could help stimulate economic growth.

Deferred Sales Trust

A Deferred Sales Trust (DST) is a tax strategy that lets property or business owners sell their assets while deferring capital gains tax over a structured period of time. This legal and flexible strategy is often used by people who want to sell highly appreciated assets but want to avoid the significant capital gains taxes from a direct sale.